time attendance software

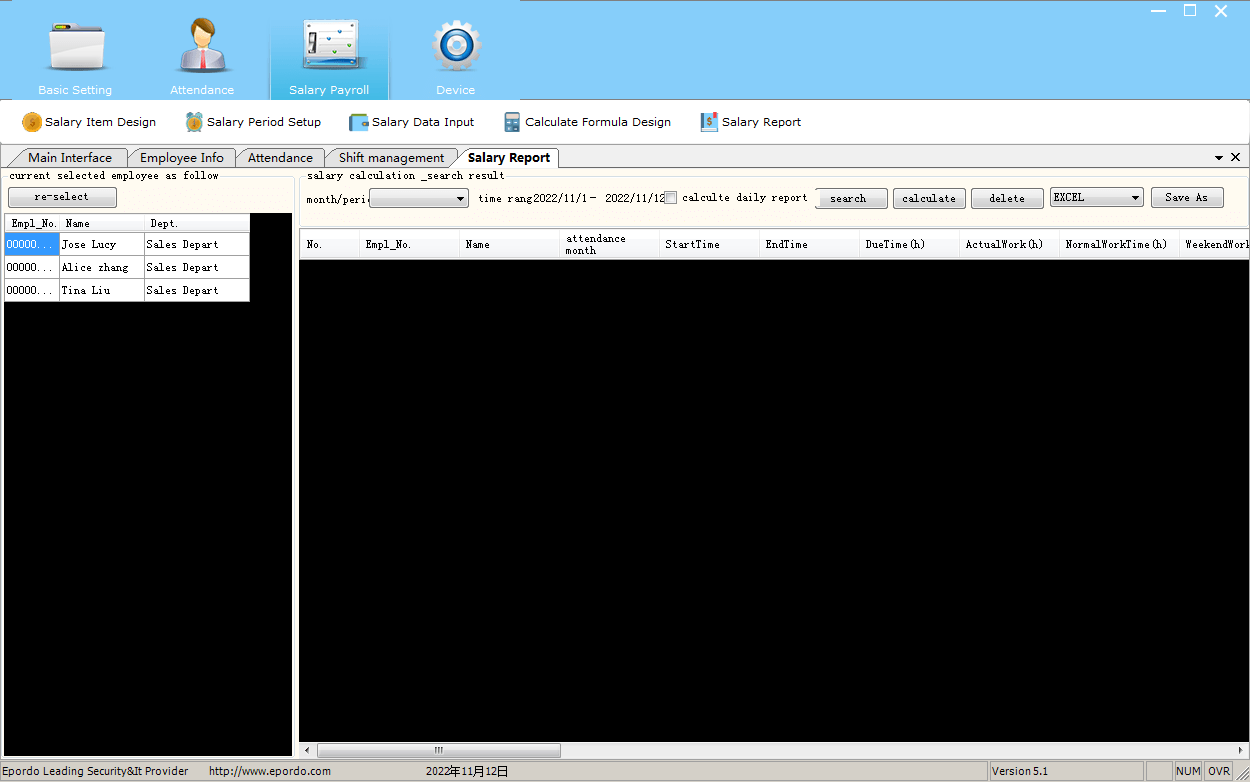

Time Attendance with Payroll Salary Function

Time Attendance with Payroll Salary Function, Epordo Payroll system, include tax, fixed salary, flexible salary, also you can define calculation formula, and program for the payroll. moreover it can work with attendance report data, it can calculate salary along with time attendance data.

Salary Function.

Standard flow to make a salary report:

ONE-TWO-TWO

One basic:

first, you should make sure the time attendance report work well,

Two define:

- salary items define

define fixed salary item ,flexible salary item, ans salary item as you need,

fixed item, mean each period or month you should pay at this item’s value, it is same each month

flexible item, also you should pay per each month or period, but it may be at a different value salary item

also is for each period or month, but this is not input manually, it is calculated according the formula you

setup, if you define such a item, please move to the salary formula define window to define its formula. - month or period info define

you can define different month or period which including different days, also its parameter like

workingdays etc can also be used in formula

Two Input Value:

Fixed Salary Item Value Input

input fixed salary item for each employee, at least all the employee you want to calculate salary

Flexible salary value Input

do the same for flexible item input, moreover, remember input all period you defined, and don’t forget to

save, otherwise you will fail to make salary report

How to Define Salary Items - space is not allowed:

all the items defined should not have space like ”monthy pay”, it must be ”monthy_pay” - ”,+,- ,/. (,),*,etc operation can not be add to item name

Income tax rate setting:

Please add you level of the income tax rate you should input start amount and end amount , and rate, it

calculate the value between start amount and end amount, for example a value 15000, according above

setting, the tax value will be calculate as following, 15000 is more than 5000 and 8000, 15000 is more

than 8000 and 13000, and 15000 is more than 13000, the tax will be

(8000-5000)10%+(13000-8000)25%+(15000-13000)*50%=300+1250+1000=2550;

Salary period setting

Start time and end time

This will be used for calculate the attendance report data for this salary period, it like attendance report

function,

For other data like totaldays, workdays, rest days, these data you can use for your special requirement, for

example, you can input a totaltime to set a rule like this, if the worktime(which you calculated according the

start time and end time in attendance report) of employee is less than this value, you will deduct money from

the salary,moreover, you can use all these data field for your special purpose

Salary period setting is a must basic setting for payroll

To View attendance devices

-

Cloud-Based Online Fingerprint Time Attendance Access Control SystemProduct on sale$259.00

-

CLOUD GPRS 4G WIFI FACE AND FINGERPRINT TIME ATTENDANCEProduct on sale$389.00

-

CLOUD FINGERPRINT TIME ATTENDANCEProduct on sale$239.00

Access Control System

Access Control System